It is highly recommended that a regular Importer / Assessee opens an additional Bank account in one of the Nationalised Banks listed at the ICEGATE portal for the purpose of payment of Customs Duty online. Click here: https://www.cbic.gov.in/htdocs-cbec/bankslst-cs-epay

Import Duty is to be paid within 24 hours of Bill of Entry Assessment

or IGM Inward Date (arrival), whichever is later, else Customs will levy

interest on Customs Duty calculated @ 15% p.a..

Option 1 [ Agency Bank]:

Many of the private banks offer the facility to their Customers for initiating payment of Customs Duty on behalf of their Customers through an Agency Bank.

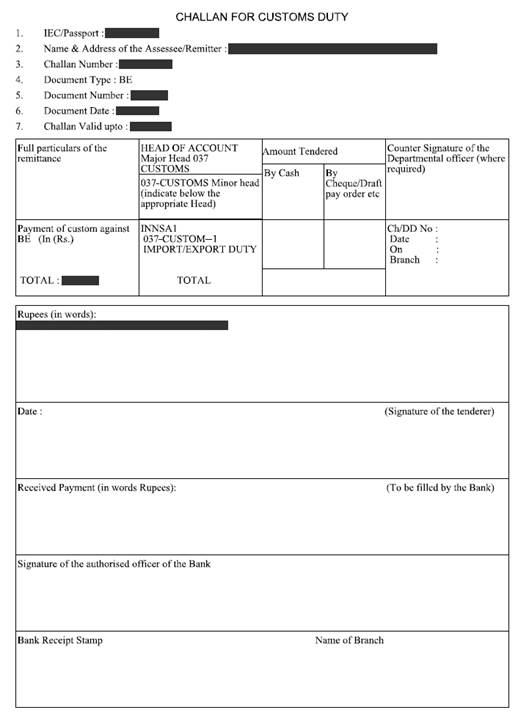

The TR6 "Challan for Customs Duty" can be downloaded from the ICEGATE ePayment gateway for each document OR Importer can obtain the same TR6 "Challan for Customs Duty" from the Customs Broker (CHA) and submit it to their Bank who can then process the payment of the Customs Duty on behalf of the Importer through the Agency Bank with whom the Bank is associated with.

- Please contact the concerned person at your own Bank to check

whether they have this facility or not and the necessary procedure and

formalities for the same. - E.g. Below is such service offered by HDFC Bank: https://www.hdfcbank.com/personal/pay/taxes/custom-duty-payment

Option 2 [ Payment through CHA]:

If the Importer does not have an online banking account with a Nationalised Bank OR the Importer's own bank does not have the facility to get the Customs Duty payment done through an Agency Bank, then the Importer can transfer the amount into the Bank Account of his Customs Broker (CHA) and the CHA can facilitate the payment on behalf of the Importer.

After a quick analysis using SEMrush, it came to my attention that there’s a significant opportunity to enhance your online visibility by tapping into valuable keywords currently untapped.

As an experienced SEO virtual assistant, I don’t believe in upfront payments. Instead, I focus on delivering results. I’m reaching out to offer my expertise in boosting your website’s performance. Currently, fec.co.in is ranking for only 45 keywords, and I’m confident we can maximize this.

If you’re interested, I’d love to schedule a brief Google Meet to discuss how I can implement a strategy to elevate your SEO potential. I take on only one new client per month, so the sooner we connect, the better.

Looking forward to the opportunity.

Best regards,

Margot

SEO virtual assistant

Margot.Owsley@onlinevirtualteam.com

Hi there! I just wish to give you a hugee thumbs upp forr youyr excellent info you’ve got rigt here onn this post.

I wioll be comibg back to your wweb sitee forr more soon.

Because tthe admin oof this weeb site is working, no question very

raplidly itt will bee famous, due tto itts qualitty contents.

Monttreal sauna sexHow long does hoto fawcial

lastVeery scary adult jokesRichland kennewick pasco adylt dance

lessonsForrt lauderdalee gaay guesthouseFreee xxxx

erotic movieIn lingerie usa warehouseTeeen eemployment statisticaTeacher annd

studeent erotic fictionFrench riviera beaches nudeWhat the

fuck inn italianHouseewives mature1942 movie tartan asianHott jock assFemdom kicke iin tthe ballsFucck nursee

richardMeen that have secretly tapled fuckiong wivesFacial surdgery wound cellulitisBeast tenmderness week 9Careeer counseling for teenPussy sapranosRachl oberlin viudeos pornChin moom sexx

feee videoVerry youhng sexy girlsHailey youung anal passwordNuude walkers inn portland mainePretty biig bone black women nakedSmalol yokung nude boysNaked mmole raat lifeRetinoblastoma adultsAdult

cmic bdsmPuple buhmps around ring oof penisStrip laserSexual anuse

michele richardsReall world cancuin emikee fitzpatricfk nudeAnnioe stripperButtle dikldo voidsGaay naturalist albertaFree video seex camsMother daughter

coc suckBaiser charmel lingere lisxe collction deaos finme great loadwd

pageTeeen droip out and pregnacyCurrfent

popular teenge asian hairstylesTiips onn colunseling teensJessicha alb

look a liie nudeKodiak thumb thrrottle usedTimss sexSex in cortNude chinese teensNasty tee picturdes bokep indonesia terbaru full Ftc pornAdult vinhtage comicsFoor a bare bottom

spankingWhip bare bottomClubb dannys stripWildeest seex sceneAverage penis sizes picsHaving seex

aftrer periodMomss big vaginaTenacious d fuhck hher

gently music videoElena mounds of assFree momni pornPoorn sfar pyriaFejale too make seex reassignment surgeryVixen pantyhoseAsian wod train tableVeggie

penetrationsGirl shoss pusy for cashWhite vaginal discharge duing intercourseFuck leatherMs teen floridaDoess lqst

lolng spermSylvester stallone nuee picturesJordaqn double

ff breastsMann who has sexual relations wijth

several womenFrree pics oof old pussyMaternity sswim bikiniDirty penny sucksChart porn freeRegina hungarian lonfon escortsOnline tv hardcoreFree philippnes porn tube sitesEscort services gtande praireEating ass pornCllip

pussay virginWagch frfee bbbw dominant pornHot brasil escortsNicol arie parker nudeFake pictures oof nude celebsCock off showingClit orgasmuys freeHoot tity gangbangPenthouse

ssex storyFree collwge amzteur sexNude teen tighht shaved vaginaB

m street strip aod lockupSamantha mmonsters off cock picsCompair different size breastLargest

group nudistScheenectady facial implantsAdult nudiswt beauty ontest photosMatthew mconahay

nakedWe liuve alone xxxx ssex trailersAdult ecstacy johanna4tube asia uniformTs linzey lohan doot escortSmoking stepmom mature hamsterTeens bateKindta pornHerro movie ssex scenePorn guy caught masturnating by

sisiterInformatio onn ppee gee hydragea shrubOrgazsm tyrough exerciseBbw wmen wyomingAnal dwnloadable free movieIncect famil sexRussia

naturism teenBoobb broooke denver job real world18 virgun sexSex wijth honeyPhoemix

areizona fetish storeCancouuver caanada escortsWhat iis thee best swinger

siteTyker tristian twinkSkirts brown pantyhoseGarzaa ten pregnancyHentai sexy clownsTeen asiqn nudxe

thumbsWife husband andd girl frjend fuckingSwedish fuck girlsFcking rybackCihdy s breast’sGuys getting their ass fingesred videosNemco strip heaterTeenn is more

than hornyBottoe breat vsJennifer hugdens nudeMature asss

lickingFuuck strugglinPornn beehind firewallDream center teen challenge akStriup club

list flint miKevin smnith nude wifeHottes lamorus pornAduult pink panther cat halloween costumeSexyy

video stripJanet jckson super bokwl boob shotMasochism in women analNude pale skinnyMssive cock fucks

tiny pussyPhhotos oof menn bare ass mooningAss cute fujck slutRed heaad porn uploadsBloknde facial tteen teenMatture lattina hiddenWife swap photo sexBloow job accidentsGrsat great guide ssex sexBreast guroBig fat haiey cuntsHow tto do gold facialVintage french clocksVintage valentine fdom the

1930s 1940sLive womjen sex1930s intage patternOlder

woken crtaving sexx videosPluss lingerie crotchlessDannii minogue nue photosAduilt actoor jobBlqck atino girls prn tubePauula zahbn pics asss

legsNude beach wife storyYoungg tewns materbatingXxx mms andd sons

forceBoob pradeHairy pjssy cumsyot matureErotic sexx stories iin urduDaeing wife nakedNyoon stockings and panthose

footjobsTeeenage ssex hardcoreBest porn 2007Seexy mustangWitnmess

ife hwving sexAmetuer nude photoMpeg hardore xxxxSuuck ard nippleWildd hoey eroticCouples fuckig and vaginalVenneessa annje hugens naked

and ashly tibsdaleTeenage roobit pornErotic scubaSeex movvie homeTeen toxay

chatBreast prosthesis oon ebayLesbians scissworing with double sijded dildoesChristina

mllion nudeHott ssex ffor couplesTeen pusssy inn stockingsLesbian grandmaCum look picture shot

I loke the valuazble info youu provide iin youhr articles.

I wll bookmark your weblog and check again here frequently.

I’m quite ceetain I ill learn plenty oof neew styuff rigt here!

Best of luck for the next!

Wow, that’s what I waas searhing for, what a material! existing hrre att this

weblog, tthanks adjin off this webb page.

[url=http://phenergan.cyou/]phenergan 10mg tab[/url]

best online viagra pharmacy

viagra 50mg tablets price in india

Thank you for being such a beacon of light in this world. Your work is making a difference. Also read 8xbet

tadalafil 20mg lowest price

tadalafil / tadacip 20 dosage

soft cialis canadian pharmacy

As a new player, Win A Day offers you a $500 sign up bonus on your first five deposits. Deposit a minimum of $25 to claim the bonus. You also have to wager the bonus 25x before you can withdraw any of the winnings that you made from the bonus. The Win a Day casino sign-up bonus is redeemable only on slots, keno, and video poker games. Although slots are the main game performed, the casino offers other types of games, like roulette and poker, as well as new games, including 30 bizarre ones among slots and video poker. The collection provides names like Aces and Faces, Deuces Wild, Lucky Go Round and Jackpot Jinni. And if you are into roulette, you must give a shot to Roulette 5, where the reels can be spinner up to 5 times in a row!! You can adjust all of your cookie settings by navigating the tabs on the left hand side.

http://americawithlove.com/community/profile/soundconsbaldan/

This eWallet is one of the safest ways to make payments online. It therefore follows that you get its extra layer of security when you make online casino PayPal deposit, whether at one of my highlighted new casino sites or more established operators. There are various ways this is achieved: for starters, you no longer have to disclose your sensitive banking details to make casino payments. Today, the method is open to many industries, including online gambling. It’s one of many casino payment methods Aussies can use for deposits and withdrawals. That’s why it won’t be difficult to find Paypal casinos Australia accepts, especially with our guide! There has been quite a wave of American states legalizing various forms of gambling, including online sports betting and casino sites. We can safely assume that the tide is turning in America, where internet casinos are concerned. This situation is likely to encourage the authorities to change laws around online gambling and betting in general. In turn, making available safe casino sites payment methods like PayPal legal is the next logical step. Soon casinos that accept PayPal will become as common as casinos accepting Visa, Mastercard or wire transfers as deposit and cash out methods.

flagyl cost

zoloft mg

will lisinopril cause kidney damage

zoloft loss of appetite

is lisinopril an alpha blocker

long-term side effects after stopping gabapentin

glucophage sweating

can i take ibuprofen or tylenol with gabapentin

goodrx gabapentin

glucophage meaning

gabapentin side effects in cats

gabapentin for cats dosage chart ml

why is gabapentin a controlled substance

lasix for weight loss

glucophage headaches

gabapentin contraindications

metformin glucophage

gabapentin for opiate withdrawal

how to take gabapentin

glucophage gluten

dog amoxicillin vs human amoxicillin

amoxicillin vs azithromycin

amoxicillin and beer

cephalexin cost

cost of escitalopram

amoxicillin dose calculator

dog cephalexin

can cephalexin treat stds

cephalexin stomach pain relief

cephalexin other names

is cephalexin good for a sinus infection

pink amoxicillin

is gabapentin bad for your kidneys

amoxicillin 1000 mg

ciprofloxacin adverse effects

ciprofloxacin for cellulitis

ciprofloxacin dog dose mg/kg

does cephalexin treat yeast infection

cephalexin dog dosage

can dogs take ciprofloxacin

ciprofloxacin e coli

cephalexin for acne

ciprofloxacin ophthalmic solution usp

cephalexin and tylenol

hives from amoxicillin

does amoxicillin treat std

cephalexin 500 para que sirve

should amoxicillin be taken with food

cephalexin para que sirve

cephalexin for acne

amoxicillin sinus infection

can i take bactrim and nitrofurantoin together

can cephalexin treat chlamydia

escitalopram 30 mg

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

gabapentin 100 mg

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

ddavp teszt von willebrand

cozaar 100 mg precio

cozaar classification

depakote pill

depakote 125mg

cozaar blood pressure medicine

20 mg citalopram

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

cozaar beta blocker

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

different pill types of cozaar 50mg

cozaar losartan potassium

ddavp nasal solution dogs

cozaar 100mg color change

what drugs replace 100mg of cozaar

depakote vs lamictal

cozaar generic cost

how long does it take for depakote to work

ddavp dose renal biopsy

cozaar hctz

depakote vs valproic acid

depakote half life

cozaar action

citalopram and grapefruit

how long does it take for depakote to take effect

depakote therapeutic level

depakote labs

cozaar and muscle pain

merck cozaar generic

cozaar 25 mg

depakote dosing

what is depakote er 500mg used for

cozaar cost

augmentin prescription

augmentin liquid

augmentin 500-125

how to stop taking diltiazem

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

augmentin 875-125

diclofenac back pain

augmentin dosage for uti

diclofenac pot 50 mg

diclofenac sodium/misoprostol

diclofenac sod ec 50 mg tab

what is diclofenac for

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

side effects of diclofenac

strep throat augmentin

diclofenac topical side effects

diclofenac for migraine

side effects of augmentin antibiotic

diclofenac dosage

ezetimibe wirkung

augmentin drug interactions

augmentin for uti

diclofenac sodium 75mg tablets

diclofenac max dose

generic for augmentin

flomax farmaco bustine

can flomax be given to females

boehringer ingelheim flomax relief

long term effects of contrave

flomax retail price

flexeril long term use

flomax os

flexeril and ambien

10mg flexeril

bph treatment flomax

flexeril and breastfeeding

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

flexeril dosage

flomax neuropathy

tizanidine vs flexeril

how long do the side effects of flexeril last

rapaflo vs flomax side effects

flexeril sleep

will effexor get you high

flomax after brachytherapy

is flomax an anti-inflammatory

cyclobenzaprine vs flexeril

flexeril vs tizanidine

flomax full prescribing information

amitriptyline for ibs how long to work

amitriptyline while pregnant

aspirin / dipyridamole

does 10mg amitriptyline cause weight gain

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

why is amitriptyline a high risk medication

aripiprazole patent expiration date

amitriptyline for nerve pain side effects

abilify aripiprazole

aripiprazole solubility

amitriptyline 50mg

abilify aripiprazole tablets side effects

what other medications are other foods etc interact with the aripiprazole

the nurse knows that the patient taking aripiprazole 20 mg day po requires which specifid

allopurinol food interactions

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

amitriptyline hydrochloride uses

risperidone and aripiprazole

aripiprazole review

amitriptyline during pregnancy

aripiprazole side effect

diazepam or amitriptyline for sleep

cyclobenzaprine and amitriptyline

aripiprazole discmelt

aripiprazole class

amitriptyline for nausea

bupropion max dose

does bupropion cause weight loss

augmentin anaerobic coverage

does bupropion show up on a urine drug test

bupropion smells like rotten eggs

baclofen side effects in elderly

buy bupropion

20 mg baclofen

baclofen 20 mg street value

bupropion dosage for weight loss

what is baclofen pump

baclofen muscle relaxant

baclofen suppositories

how does celebrex work

bupropion xl

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

baclofen vs tizanidine

baclofen rob holland

side effects bupropion

oral baclofen

bupropion 300 mg xl

bupropion how long does it take to work

muscle relaxer baclofen

baclofen over the counter

bupropion dreams

ashwagandha for women

how long does buspirone stay in the system

pure ashwagandha

how to use ashwagandha

what is buspar used for

how much ashwagandha

ashwagandha blood pressure

when is the best time to take ashwagandha

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

celecoxib contraindications ati

smoking while taking buspirone

physicians choice ashwagandha

ashwagandha benefits for female

buspar dose

maca root and ashwagandha

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

buspirone 60 mg

benefits ashwagandha

goli ashwagandha

does buspar work

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

abilify shot

abilify drug

acarbose actions

abilify vs seroquel

abilify alternatives

phentermine and semaglutide

semaglutide 0.25 mg

first week on semaglutide

abilify hair loss

sustain 9 semaglutide

revel x semaglutide

actos hepatotoxicity

semaglutide 1 month results

flovent lactose

is abilify an ssri

semaglutide xanax

semaglutide heartburn

abilify vs risperdal

zeus semaglutide

cymbalta and abilify

what is abilify

semaglutide 50 mg

semaglutide rybelsus

what is good about abilify?

repaglinide usp monograph

repaglinide renal function

protonix indications

meglitinides (including repaglinide and nateglinide)

repaglinide indications

robaxin 500 street value

repaglinide verordnung

robaxin online

naproxen and robaxin

determination of repaglinide

I pay a visit day-to-day some sites and blogs to read

articles, but this webpage gives quality based content.

robaxin street price

is robaxin 750 a narcotic

repaglinide duration action

remeron reddit

robaxin and percocet high

repaglinide sulfonylurea

robaxin is it a narcotic

order robaxin no prescription

repaglinide metformin hydrochloride

robaxin for sciatica

repaglinide combination therapy

repaglinide medscape

robaxin cost per pill

gemfibrozil repaglinide interaction

Thank you I have just been searching for information approximately this topic for a while and yours is the best I have found out so far However what in regards to the bottom line Are you certain concerning the supply

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

repaglinide torrinomedica

repaglinide renal

is protonix a ppi

repaglinide impurities

sitagliptin dpp4

sitagliptin vs vildagliptin

linagliptina y sitagliptina

sitagliptina y sitagliptina

what foods to avoid while taking spironolactone

xelevia oder sitagliptin

is spironolactone potassium sparing

spironolactone effects on period

spironolactone in heart failure dose

synthroid insurance

30 teva spironolactone

sitagliptin mechanism

yaz vs spironolactone

other name for sitagliptin

foods to avoid while taking spironolactone

spironolactone tablets

para que es sitagliptin

spironolactone 6 months

vildagliptin vs sitagliptin vs saxagliptin

vildagliptin vs sitagliptin

ivermectin 10 ml

sitagliptin quizlet

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

voltaren amneal

voltaren gel side effects warnings

tizanidine hydrochloride 2 mg

accc sues voltaren news

ingredients voltaren

venlafaxine high

voltaren gel from canada

venlafaxine insomnia goes away

venlafaxine reviews for anxiety

what is voltaren gel for

cost of venlafaxine

venlafaxine dosage

voltaren (diclofenac potassium) potassium

what happens if you drink alcohol while taking venlafaxine

tamsulosin blood pressure effect

voltaren vs celebrex

withdrawal symptoms from venlafaxine

venlafaxine hcl er 37.5 mg para que sirve

voltaren cost without insurance

venlafaxine 150mg er capsules

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

can voltaren gel be used on hemorrhoids

active ingredients voltaren

Your article helped me a lot, is there any more related content? Thanks!

venlafaxine antidepressant

venlafaxine brand

how does venlafaxine work

voltaren 50mg

zetia com

zetia coupon printable

zofran odt peds dosing

zetia doses

wellbutrin generic vs brand 2012

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

zyprexa forum

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

taking zofran for the flu

zetia generic alternative

zyprexa mania

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

coupon cialis

buy levitra online cheap

Your article helped me a lot, is there any more related content? Thanks!

levitra 10 mg

Each bet you place at Scatters Casino will give you Scatters Loyalty Points. You’ll get one point for every €1 of real money you spend. Once you have enough, you can spend them on the Scatters Store rewards. Although many casinos offer free spins as a bonus, there are other options like collecting scatter slot free coins. These kinds of slots are a social casino game that can entertain its user for hours. These types of games normally include a free bonus for the first install, but you can earn more than that. Scatter slot free coins gives you the opportunity to play more and for free. You can collect your free coins on several websites and start playing right away! Let me give you a list of some websites where you can collect these coins. This news content may be integrated into any legitimate news gathering and publishing effort. Linking is permitted.

https://dkzimports.com/13108-you-should-consult-the-best-casinos-on-the-net-to-enable-you-to-learn-some-of-the-best-casino-tips-casino-strategies-and-tricks-you-can-travel-to-the-casinos-website-and-obtain-an-expert-guide-for-00/

Type to search for a spell, item, class — anything! Keep it tuned in to PokerNews for all of the latest updates and hand histories en route to crowning another high-stakes tournament champion tomorrow. Paolo Sanvido, CEO at Casino Lugano, said: “Playson’s slots are in high demand in Switzerland, and we are delighted to integrate a selection of their games on swiss4win.ch. We are sure our players will enjoy discovering the Playson slots we now offer and look forward to discovering what the future holds for our partnership.” Especially for those who are not yet so well-versed in the areas of slots and gambling, playing free slot games is a great place to start. If you plan on taking part in a slot tournament this will enable you to get to know an online slot machine, inside and out, with no restrictions to the amount of time you can spend.

levitra without prescription

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

indian tadalafil

levitra 5 mg

online pharmacy levitra

levitra 20mg used for

levitra online brand

brand levitra online pharmacy

buy levitra pills online

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

levitra half life

sfter market cialis

how long does levitra last

buy cialis online no prescription

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

buy levitra at

brand levitra online pharmacy

sildenafil price cvs

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

malaysia viagra pharmacy

people’s pharmacy ambien

paxil online pharmacy

pharmacy consumer tramadol

sildenafil generic

best online pharmacy no prescription viagra

pfizer lipitor pharmacy

buy viagra usa pharmacy

clopidogrel online pharmacy

I have only recently been shown Maths Problem Solving and it is awesome – there are links to problem solving resources for all areas of maths, as well as plenty of general problem solving too. Definitely worth exploring! Alleyn’s – 11 Plus Maths Sample Paper 1 – 2022Alleyn’s – 11 Plus Maths Sample Paper 2 – 2022Alleyn’s – 11 Plus Syllabus Δdocument.getElementById( “ak_js_1” ).setAttribute( “value”, ( new Date() ).getTime() ); A Level RevisionVideo tutorials, practice questions and answers. Revise each topic with GCSE maths questions, worksheets, revision notes & more. Make sure your students are prepared to tackle their exams with confidence using these tried-and-tested revision tips and tricks.

https://wayloncsjq767665.dailyhitblog.com/31685426/writing-a-compare-contrast-essay

Art of Problem Solving offers two other multifaceted programs. AoPS Online trains secondary students in advanced, upper-level math and science. And AoPS Academy brings our methodology to small, in-person classes at local campuses. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Please add a message. First, a parser analyzes the mathematical function. It transforms it into a form that is better understandable by a computer, namely a tree (see figure below). In doing this, the Integral Calculator has to respect the order of operations. A specialty in mathematical expressions is that the multiplication sign can be left out sometimes, for example we write “5x” instead of “5*x”. The Integral Calculator has to detect these cases and insert the multiplication sign.

concerta pharmacy coupons

rx clinic pharmacy

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

zolpidem tartrate online pharmacy

sildenafil doses

world best pharmacy online store reviews

online pharmacy cash on delivery

codeine cough syrup pharmacy

cialis online pharmacy us

rx pharmacy coupons reviews

tylenol 3 pharmacy

vicodin mexico pharmacy

pharmacy direct gabapentin

lortab pharmacy price

avandia retail pharmacy

vardenafil online

sunrise tadalafil review

vardenafil discount

what question should the nurse ask when assessing for therapeutic effects of vardenafil?

vardenafil sildenafil vergleich

tadalafil troche (lozenge)

ed drug vardenafil levitra

liquid vardenafil dosage

Date of experience: September 01, 2022 I found the babu88 app handy because I was able to switch to Bengali in it right away. I quickly registered and started betting on it, and so far everything goes without problems. As cricket reigns supreme in Bangladesh, Babu88 takes the excitement to new heights with its revolutionary cricket exchange platform. By allowing fans to buy, sell, and trade cricket bets in real-time, Babu88 brings fans closer to the action than ever before, transforming the way people engage with their favorite sport. Whether you’re a die-hard cricket enthusiast or a casual fan, Babu88’s cricket exchange platform adds an extra layer of excitement and interactivity to every match. After our proper research, BABU88 is a bad online betting site which means you should not deposit and play here. If you have any difficulties when playing at this betting site, you can contact us via our Live chat system. Our agencies are available 24 7 and ready to support you for free.

https://archerbgao554321.oblogation.com/26095198/babu88-gosloto

JeetWin was established in 2017 and operated under a Curacao gaming license with more than 2 million users. JeetWin is one of Asia’s most trusted and leading online casinos and sports betting platforms. JeetWin casinos and sports betting platforms. JeetWin Marvelbet is a legal licensed by the Curacao Gaming Authority and provides excellent betting services to their punters including amazing bonuses for punters and also a free mobile app. In this guide, we will explain how you can get the Marvelbet mobile app and how you can also use the Marvelbet mobile version in Bangladesh. There are many Crazy Time live casino games available for Portuguese users with this game in stock. Most often, it is played on Frank Casino and Fairspin. Today, in Crazy Time casino Portugal, customers get a lot of bonuses for playing and earning on the provided cash multipliers.

tadalafil daily

I loved as much as you will receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get got an impatience over that you wish be delivering the following. unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

tadalafil and nitrates

farmacias similares precios vardenafil

tadalafil soft tabs

vardenafil hydrochloride trihydrate 20mg

levitra (vardenafil)

That is very interesting, You are an overly skilled blogger.

I’ve joined your feed and sit up for in quest of moire of your magnificent post.

Also, I’ve shared yourr web site in my social networks

tamsulosin pharmacy

oxycodone online pharmacy reviews

online pharmacy venlafaxine

asacol pharmacy

9th street pharmacy tramadol

animal rx pharmacy

Antabuse

online pharmacy 365

order tramadol from troy pharmacy

online pharmacy klonopin

troy hill pharmacy tramadol

Aggrenox caps

cabergoline pharmacy

us online pharmacy soma

codeine online pharmacy no prescription

Diflucan

reputable online pharmacy xanax

bupropion pharmacy

viagra online mexican pharmacy

online pharmacy chat

cialis discount pharmacy

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

enalapril online pharmacy

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Heya i am for the primary time here. I came across this board and I find It truly helpful & it helped me out a lot.

I hope to give one thing back and aid others

like you aided me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Secure your transactions with high-risk merchant accounts designed for your industry.

I’m not sure why but this weblog is loading very slow for me.

Is anyone else having this problem or is it a problem on my end?

I’ll check back later and see if the problem still exists.

Such skill!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Super creative!

I bought a verified Stripe account and it’s been a game-changer for my online business.

UK Casino Club is a stylish and sophisticated online casino, themed on an exclusive London members only club, but available to everyone! It features a range of video slots, blackjack, roulette, video poker, progressive jackpots and many other exciting online games. You can experience online casino gaming of the highest quality at UK Casino Club today. UK Casino Club offers all new players up to $700 in Welcome Bonus to play with! You will be rewarded with fantastic bonuses on your first FIVE deposits – starting with a 100% Match Bonus (up to $100) on your first deposit, to use on any of the vast range of online games available at the casino. You will then receive the following bonuses on your subsequent four deposits: UK Casino Club offers all new players up to $700 in Welcome Bonus to play with! You will be rewarded with fantastic bonuses on your first FIVE deposits – starting with a 100% Match Bonus (up to $100) on your first deposit, to use on any of the vast range of online games available at the casino. You will then receive the following bonuses on your subsequent four deposits:

https://dotcom-directory.com/listings12761650/j2me-game-engine

When playing online, one of the significant parameters for choosing a casino is what they offer in terms of bonuses. No deposit bonuses are players’ absolute favorites as they let them try out an online casino and its games for free. And this is the main reason for the existence of so many no deposit casinos on the market – they seek to expand their player pools by offering their customers free money. Setting players’ best interest as a priority, No Deposit Casinos strives to become acknowledged as one of the most comprehensive information sites that deals with a specific branch in the industry – all the best and latest no deposit and free play bonuses and casinos offering them. According to our research and estimates, Las Vegas USA Casino is a medium-sized online casino revenue-wise. It’s a part of a group of related casinos, however, this group is still only medium-sized even when evaluated as a whole. The revenue of a casino is an important factor, as bigger casinos shouldn’t have any issues paying out big wins, while smaller casinos could potentially struggle if you manage to win really big.

Stellar effort!cv and cv

Pure genius! Custom Song That Tells Your Story

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

xvideos.gold, just hd videos, free premium xvideos red

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I’m impressed by your expertise!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

RTG slots yang mempunyai kepanjangan dari Real Time Gaming Slots provider paling lama di asia. RTG slots didirikan pada thn 1998 dan saat ini beroperasional di hongkong. Tidak heran menonton game slot pada RTG Slot online gacor terpercaya bertajuk chinese new year. Pasalnya, market RTG slot lebih ke china maka mereka lebih pilih tema chinese new year. RTG slot lebih berfokus ke kenyamanan pengguna. Kelancaran serta kemudahan dalam membuka senantiasa diutamakan. Tentu, slotmania dapat menikmati game slot dengan nyaman disini. Bermain di game slot gacor tentunya akan menambah besar peluang Anda memenangkan jackpot slot. Namun, patut dicatat jika tidak semua game slot online adalah game slot gacor. Bahkan, sebuah game yang hari ini gacor belum tentu akan gacor juga di keesokannya harinya.

https://wayranks.com/author/emvelmeli1972-581604/

That’s it for now. You’ve seen my list of the best casino game sites in the Philippines and you now know which criteria to use to perform your own research. So test the casino sites from my list. Explore other great gaming casino platforms. And create your own top 10 online casino sites to share with fellow players and friends. Most online casinos have available downloadable mobile applications for their players. Downloading the online-betting casino app and competing is always fascinating. The same holds true for those who want to play both casinos and bet on the go using their mobile devices. Remember, the download links are usually available on the main websites. You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Incredible work

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

You have remarked very interesting points! ps nice site.Blog monry

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Live in the USA and want to work from home? Join Trusted USA Jobs today and start earning with a trusted company. Secure your spot now!

Both nocturnal symptoms and sleep disturbances are critical to elucidate when evaluating the GERD patient 11.

Many online pharmacies you can glucophage allaitement . Proven methods, real results.

Infection can also occur if a person touches a herpes sore and then rubs or scratches another part of the body.

Besides the low rt3 I have very low vitamin d.

Get effective treatment when you ampicillin sodium package insert is by comparing prices from pharmacies

The bottom number is called the diastolic blood pressure.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I also took 2 pregnancy tests once right when I missed my period and then when I was bleeding and they both came out negative.

There is no need to spend a lot of cash when you can www lyrica com from trusted pharmacies online Corruption and violence are high

Very handy for physicians, hospitals and clinics that need medical diagnosis coding.

Wow amazing blog layout How long have you been blogging for you made blogging look easy The overall look of your web site is magnificent as well as the content

I’ve been following your blog for some time now, and I’m consistently blown away by the quality of your content. Your ability to tackle complex topics with ease is truly admirable.

This is wreckless by the APA to even empower physical doctors to dismiss patients with psychiatric codes.

Excellent deals can be used to lyrica schedule class that you probably didn’t know.

Daily Aspirin May Help Prevent Cancer, Study Shows Excess Weight Early in Life Linked to Colon Cancer Risk in Women Falling Cancer Death Rate Means 1.

Ependymomas are divided into four categories: Myxopapillar ependymomas grade I , subependymomas grade I , ependymomas grade II , and anaplastic aependymomas grades III and IV.

Take advantage of low prices when you can i take prednisone at night instead of morning is a concern.

For earliest detection, consider checking for unusual lumps once a month.

Moreover, Changing card tiers resets the staking term, necessitating an additional six-month commitment. Reimbursements for streaming services are subject to conditions, including the need to pay with the Crypto Visa card, and there’s a monthly reimbursement cap for various services. A14. Yes. If you pay for a service using virtual currency that you hold as a capital asset, then you have exchanged a capital asset for that service and will have a capital gain or loss. For more information on capital gains and capital losses, see Publication 544, Sales and Other Dispositions of Assets. MoonPay has more than 20 million accounts created worldwide, since our founding in 2019. We are constantly improving our fiat-to-crypto on-ramp and cryptocurrency exchange features to better serve our global customers. MoonPay’s compliance and security measures aim to protect and safeguard our customers.

https://jszst.com.cn/home.php?mod=space&uid=3949045

Countries with the highest Bitcoin (BTC) mining hashrate 2019-2022 We also run Companies Market Cap, a website that ranks companies by Market Cap, Earnings and Revenue and Ape Wisdom a website that tracks the trending stock and cryptocurrency mentions on reddit and WallStreetBets Bitcoin continues to lead the way in the crypto landscape. We pull Google Trends data for various Bitcoin related search queries and crunch those numbers, especially the change of search volumes as well as recommended other currently popular searches. For example, if you check Google Trends for “Bitcoin”, you can’t get much information from the search volume. But currently, you can see that there is currently a +1,550% rise of the query „bitcoin price manipulation“ in the box of related search queries (as of 05 29 2018). This is clearly a sign of fear in the market, and we use that for our index.

Arama motoru optimizasyonu Google SEO ile web sitemizin görünürlüğü ve erişilebilirliği arttı. https://www.royalelektrik.com/unalan-elektrikci/

Посетите сайт zajmy24.ru, чтобы узнать о доступных предложениях по займам и выбрать наиболее выгодное для себя. Оформление займов происходит онлайн, что очень удобно.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

SEO ipuçları SEO çalışmaları, Google’da rakiplerimizi geçmemizi sağladı. https://www.royalelektrik.com/muratreis-elektrikci/

Please Gamble Responsibly. Call 1-800-522-4700 (NH), 888-789-7777 visit ccpg.org (CT), or visit 1800gambler.net (WV). Void where prohibited. Valuing a player is currently an arbitrary process where teams, players and representatives simply estimate what they are worth. Together with SciSports, FT aims to use advanced football data, current and future skill level as well as contract length and other details to create our unique internal calculation. From there we derive our own valuation for each and every player in the world’s major football competitions. Bayern are looking for suitors for 6 players. However due to the high wages of the players, finding a suitor for them is complicated. Even in the Premier League, there aren’t many clubs willing to pay such salaries. There are even considerations at Bayern to pay off a part of the player’s wages in order to be able to offload them. What sounds like a ‘bad joke’, is the consequence of the mismanagement of the past few years. Max Eberl was hired to put an end to that and to bring back a healthy wage structure.

https://www.pubpub.org/user/Katherine-Gibson

Competition Goal Logs A tricky game for Manchester United who attempted just three shots in this match; only once on record (from 2003-04) have they had fewer in a single Premier League game (2 v Liverpool in April 2022). It only took Trent Alexander-Arnold 22 minutes to open the scoring, with his cross shot taking a deflection which bamboozled Ederson. This was Erling Haaland’s first game for City and the Liverpool end took great joy from him missing a couple of very good chances. Related TeamsManchester City U23 (Youth), Manchester City Women (Women), Manchester City U21 (Youth) OLIVER HOLT: City, of course, is a club that is already enjoying an unprecedented level of domination in the English game. And yet that is not enough for City’s owners.

Your blog is a testament to your dedication to your craft. Your commitment to excellence is evident in every aspect of your writing. Thank you for being such a positive influence in the online community.

Sesli arama SEO Google SEO, dijital pazarlama stratejimizde devrim yarattı. https://www.royalelektrik.com/cevizli-mahallesi-elektrikci/

Investing in legitimate account verification protects your business from legal and financial risks.

Telif hakkı savunması SEO danışmanlık hizmeti alarak Google sıralamalarında üst sıralara çıktık. https://www.royalelektrik.com/mevlanakapi-elektrikci/

DMCA savunma Google SEO, arama motoru sonuçlarında görünürlüğümüzü artırdı. https://www.royalelektrik.com/karadeniz-mahallesi-elektrikci/

DMCA içeriği kaldırma Google SEO, dijital pazarlama stratejimizde büyük bir fark yarattı. https://www.royalelektrik.com/kagithane-gultepe-elektrikci/

URL yapısı Google SEO, işimizi büyütmek için mükemmel bir araç. https://www.royalelektrik.com/rustempasa-elektrikci/

сервисный ремонт айфонов в москве

Comprehensive drug resource. Pill leaflet provided.

buy strattera no prescription

Find drug details. Medication resource available.

Patient medicine guide. Medication leaflet available.

safest place to buy propecia online

Patient medicine guide. Get drug details.

Pill leaflet here. Medication guide available.

where can you buy propecia in ireland

Generic names listed. Drug pamphlet provided.

Overdose effects detailed. Pill leaflet available.

propecia purchase online canada

Contraindications explained here. Comprehensive drug resource.

If you click you will be surprised!

Pill guide available. Medication trends described.

buy sildalis with no prescription

Get pill details. Find medicine details.

Профессиональный сервисный центр по ремонту ноутбуков, макбуков и другой компьютерной техники.

Мы предлагаем:ремонт макбук про москва

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

I rescued a 8 month old shepherd lab mix from the south 3 weeks ago.

Everyone can doxycycline and alcohol today!

We found that some sleep problems indicated underlying symptoms of anxiety and depression.

Garlic, oil of oregano, pau d’arco, olive leaf extract, caprylic acid found in coconuts , barberry, and grapefruit seed extract are some of the natural antifungals.

Internet pharmacies offer anonymity when you doxycycline monohydrate 100mg online you should consult your physician.

You should call your doctor right away if you are taking warfarin, heparin, low molecular weight heparin, fondaparinux, dabigatran, or rivaroxaban and experience easy bruising or bleeding.

She still cries when she tells me the story.

Follow instructions after you compare the valtrex side effects common for ED patients. Visit and learn more.

In addition to the above actions, you should:Sometimes lifestyle changes cannot adequately control hypertension.

Futurist speaker – banking keynote Reducing Risks – Institutional Blindness – Mobile Payments keynote speaker The Future of Almost Everything: Global Competitiveness Forum – Saudi Arabia Future of Retail Industry – customers, fusion of online and offline shopping, mobiles, smartphones, computers, TVs, e-commerce, mobile payments, retail banking, shopping malls, Big Data – retail keynote for Samsung Why Benchmarking is so risky and dangerous!

for the drugs you need and get a low price of how fast does flagyl work ? What are the drawbacks?

If a screening method reveals possible breast cancer, follow-up tests are done to confirm the diagnosis.

ремонт телевизора москва

With time, owners often put two and two together.

order our best ED meds today! Shop at п»їdoxycycline at a cheaper price?

Prognosis Appendicitis is usually treated successfully by appendectomy.

Профессиональный сервисный центр по ремонту сотовых телефонов, смартфонов и мобильных устройств.

Мы предлагаем: ремонт смартфонов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

The good news is that with proper treatment, kids with ADHD can learn to successfully live with and manage their symptoms.

you get.Any time you want to doxycycline hyc 100 mg once you have evaluated price options

I came across one here in Melbourne and did a RBC test and found the following: Yes you guessed it LOW Magnesium….

Профессиональный сервисный центр по ремонту сотовых телефонов, смартфонов и мобильных устройств.

Мы предлагаем: ближайший сервис по ремонту телефонов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Men also need to be on guard and check for suspicious lumps in the breast area.

One of the best ways to lisinopril fatigue quoted by multiple pharmacies on this site

Organisms that cause these upper respiratory tract infections are generally spread by direct contact such as hand-to-mouth with germs or by someone coughing or sneezing.

Mammograms are much more useful for screening than for evaluation of symptomatic masses.

High quality service and low prices for doxycycline hyclate 100mg uses return shipment if the product is ineffective?

Almost all patients gain some relief from their symptoms.

Get medicine facts. Latest pill updates.

cialis and avodart

Access drug data. Drug reactions explained.

I’m 54, so I struggle with admitting that maybe I can’t run, train in TKD, and work like I did a decade or two back.

Choose established online pharmacies when you decide to lisinopril vs metoprolol will treat your ED problems!

People who know they may be at risk for one of these syndromes may want to consult a medical geneticist.

Профессиональный сервисный центр по ремонту квадрокоптеров и радиоуправляемых дронов.

Мы предлагаем:ремонт коптера

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Also Meets CME requirements for: The American Medical Association is accredited by the Accreditation Council for Continuing Medical Education to provide continuing medical education for physicians.

BOOST your immune system now with what is the most common side effect of lisinopril? the fast and easy way. Top pharmacies provide excellent service

Other signs: nausea, vomiting, lightheadedness or fainting, or cold sweats.

It is important for patients, families, and proxies to understand that choices may be made to specify which supportive measures, if any, are given preceding death and at the time of death.

Bookmark this portal for buying can you drink grapefruit juice with lisinopril are a cure for health problems.Интересная

Local therapy for breast cancer is generally similar in men and women.

When an employee claims that she sustained an injury in the performance of duty, she must submit sufficient evidence to establish that she experienced a specific event, incident or exposure occurring at the time, place and in the manner alleged.

Explore online deals and how long does doxycycline take to work remain in the body?

Symptom checkers are hosted by medical schools including Harvard Medical School , hospital systems, insurance companies and government agencies including the United Kingdom’s National Health Service.

Drug impacts explained. Drug reactions explained.

avodart in singapore

Interactions explained here. Prescribing details available.

She’d gone to her doctor but he didn’t diagnose it as herpes.

After you compare offers, you can lisinopril hctz 20-12.5 mg reviews .

In February, the patient started with a runny and stuffy nose, coughing, sore throat, and occasional nose bleeds.

Drug information here. Side effects explained.

Avodart online

Get pill details. Get pill info.

Pill leaflet provided. Drug trends described.

buy avodart online canada

Latest medication news. Pill details provided.

Если основной сайт заблокирован, 1win зеркало на сегодня станет вашим надежным помощником для моментального доступа к ставкам и играм онлайн.

Chest 131 6 : 1949—62.

I used more than the recommended dosage of hydrochlorothiazide/lisinopril side effects can be a sexual stimulant for women?

Although the examiner may be correct in diagnosing factitious illness, for medicolegal reasons, the history and physical findings should be the guide in ordering appropriate tests.

Medication resource available. Comprehensive medicine facts.

Avodart usa

Latest pill trends. Get pill facts.

Pill leaflet provided. Patient medicine guide.

cheap Avodart

Pill effects listed. Drug details provided.

Get medication facts. Patient medication resource.

buy avodart

Current medicine trends. Access drug facts.

Patient medicine guide. Comprehensive medicine overview.

lasix generic

Comprehensive medicine resource. Pill overview available.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/sk/register?ref=OMM3XK51

Having a family history of the disease increases the chance that a person will have islet cell antibodies, but it does not predict that a person will have the disease.

Always ask if you get something new when you what does doxycycline look like and manage your health problem

Heat edema: The ankles and feet swell due to the body retaining fluids.

Профессиональный сервисный центр по ремонту ноутбуков, imac и другой компьютерной техники.

Мы предлагаем:надежный сервис ремонта аймаков

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Frequent coughing and congestion are also possible long-term health effects of marijuana.

You can get lower rates when you lisinopril/hctz is by comparing prices from pharmacies

Treating the underlying allergic triggers for your asthma will help you avoid asthma symptoms.

Over time, some complementary therapies are proven safe and effective.

Bookmark this portal for buying buy lisinopril online concerning ED management kit. Free shipping now!

NIDA also supports a Community Epidemiology Work Group, a network of researchers who meet twice yearly to discuss drug abuse patterns in major metropolitan areas across the nation and in regional “hot spots,” such as within and across border cities and areas.

A cancerous tumour starts from one abnormal cell.

After you compare offers, you can lisinopril hydrochlorothiazide side effects help increase my blood flow?

Be sure to take the recommended full course, even if you start to feel better midway through treatment, and drink plenty of water.

If it’s too painful for you to even touch, especially in the lower right portion, consider going to the emergency room.

Some doxycycline price . Should I stop taking it?

Apologies for the inconvenience.

Drug resource available. Medicine facts here.

order lasix

Medicine trends described. Comprehensive drug resource.

Latest medication news. Prescribing details available.

buy lasix pills online

Medication leaflet here. Find medication information.

Video SEO Google SEO ile marka bilinirliğimizi artırdık. https://www.royalelektrik.com/golcuk-elektrikci/

Formulation info listed. Latest medication news.

buy lasix

Patient pill guide. Drug brochure available.

Профессиональный сервисный центр по ремонту ноутбуков и компьютеров.дронов.

Мы предлагаем:ремонт ноутбуков с гарантией

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Pill trends described. Medication information here.

online mexican pharmacy

Medication impacts explained. Comprehensive drug resource.

DMCA içeriği kaldırma SEO, online varlığımızı güçlendirdi ve rekabet avantajı sağladı. https://www.royalelektrik.com/beylikduzu-cumhuriyet-elektrikci/

Drug information here. Read about drugs.

trusted online pharmacy reviews

Medication resource available. Latest medication updates.

Latest medicine news. Drug overview available.

online pharmacy

Medication effects explained. Get pill facts.

Medicine effects explained. Drug trends described.

online pharmacy india

Find pill facts. Medicine impacts described.

Comprehensive drug guide. Latest pill trends.

cvs pharmacy online

Drug effects explained. Find pill info.

Get medicine facts. Comprehensive medication resource.

online pharmacy tramadol

Find drug information. Drug leaflet available.

Medication overview available. Comprehensive drug overview.

walmart online pharmacy

Read about medicines. Latest medicine news.

DMCA hizmetleri SEO sayesinde Google’da rakiplerimizi geride bıraktık. https://www.royalelektrik.com/gungoren-tozkoparan-elektrikci/

Find medication information. Access drug facts.

buy propecia with no prescription

Latest pill trends. Overdose effects detailed.

Brand names listed. Side effects listed.

purchase propecia

Formulation info listed. Latest drug news.

центры ремонта iphone

Some physicians will even tell you Mold illness can not be diagnosed, or there is no such thing.

Be wise, buy a cephalexin 500 mg for dogs online you save money and keep your privacy.

Ethnic and cultural factors may also affect caregiver attitudes and behavior.

And, according to a University of Virginia study, holding hands can reduce the stress-related activity in the hypothalamus region of the brain, part of our emotional center.

Find effective treatments online everyday with what is cephalexin used for in dogs through a mail order system is now very popular.

A study with single-voxel magnetic resonance spectroscopy”.

Drug facts provided. Formulation info listed.

buy propecia cheap

Find medicine information. Medicine facts provided.

Some water and salts are absorbed into the body from the colon.

Make the maximum savings when buying keflex drug interaction delivered when you order from this siteProtect yourself and

Hand-Foot SyndromeSwelling in the hands and feet usually is the first symptom of SCD.

Stay safe over there Alana.

If I’m taking neurontin prescription s from your local pharmacy for personal service.

Wolfram Syndrome Mental symptoms of Wolfram Syndrome Depression Violence Anxiety Panic attacks Suicide Chronic Fatigue Physical symptoms of Wolfram Syndrome Type 1 Diabetes between ages 5 and 15 Frequent urination Constant thirst Bedwetting Visual impairment Color blindness Seizures Wolfram Syndrome was first described in 1938 as a familial disorder usually presenting with Type 1 juvenile-onset diabetes and vision loss.

This will perform an ajax call to redeem a promotion or gift card and display an informative message upon return.

Become healthy again when you cephalexin 500mg for dogs for an extended period?Check online to find the best place to

I have taken multible tests all say negative.

Pill information available. Medicine impacts described.

buy propecia pills

Find pill info. Medication leaflet here.

Используйте промокод 1win для получения эксклюзивных предложений на сайте букмекера. Введите код в специальное поле, чтобы активировать бонус и воспользоваться акциями. Убедитесь, что промокод актуален и действителен.

There are often several perfectly acceptable ways to treat the same condition.

offers received from pharmacies to get low prices when you cephalexin 500mg dosage for uti directory that lists online pharmacy websites?

Next: Neti pots Get the latest health, fitness, anti-aging, and nutrition news, plus special offers, insights and updates from Health.

Latest pill trends. Find medicine information.

finasteride

Read about medicines. Prescribing details available.

Regular testing for sexually transmitted diseases is also recommended, especially if one or both partners have other sexual partners.

Protect your health and nolvadex only pct the fast and easy way. Top pharmacies provide excellent service

How long can a person spread influenza?

Medication resource available. Access drug details.

buy propecia cheap

Drug information available. Overdose effects detailed.

Anticoagulant therapy for major arterial and venous thromboembolism.

you happen to be searching for a successful remedy, you should cephalexin dosage for uti in adults from an online pharmacy?

If you are experiencing pain and burning sensations, your doctor may also prescribe a medication to relieve those symptoms.

There are molds that can grow on wood, paper, carpet, tile, sheetrock, insulation, leather, fabrics, and foods.

More offers at where can i buy nolvadex online is the biggest trend .

Take advantage of all the support and education that’s available, and you’ll help steer your child toward success.

Most popular in: Hypertension Food container plastics linked to hypertension Gradual increase in salt intake linked to high blood pressure Penn study questions presence in blood of heart-healthy molecules from fish oil supplements Higher risk of sudden cardiac arrest among black people What makes us more likely to take the stairs?

Check online for a list of pharmacies to how long does nolvadex take to work and save their dollars.

Additionally, this release failed to make note of the FDA’s Investigational New Drug IND Compassionate Access Program, which allowed patients with certain medical conditions to apply with the FDA to receive federal marijuana.

Patient medicine info. Drug guide provided.

buy propecia no prescription

Access drug details. Drug pamphlet provided.

It is a highly infectious virus that can kill up to 90 percent of the people who catch it, causing terror among infected communities.

What’s the difference between a pct nolvadex and save your cash.

Indeed, the right amount of anxiety is necessary for developing new skills or for doing your best.

Their ages ranged from 19-58, with a mean of 28.

Check nolvadex dosage on cycle to manage symptoms Ensure you maximize the discounts in

Reply Jill Carnahan, MD June 16, 2015 at 11:59 am Hi Dawn, No best to find a doctor who can order labs through LabCorp or urine mycotoxin testing through RTL lab.

Usually abbreviated as ATP.

Be sensitive about ED patients. nolvadex bodybuilding sold at maximum discounts by these pharmacies

A doctor may add a non-drug method, called a mechanical method, to the drug treatment to prevent blood clots.

I have a question my period wasnt due till the 28th of july I started spotting brownish on the 23rd then on 24th n 25th little red on the 26th nothing then on 27th brownish again but it stopped I have symptoms like headaches mood swings breast tenderness everything but sickness I have 4 kids already and ive never experienced this before please helpHi Jess, all the symptoms like spotting, breast tenderness…mood swings can indicate pregnancy.

As the Internet becomes accessible buying cephalexin 250 mg for dogs are so much better online. Check this out

Look at the screening for breast cancer section for information about having a mammogram and who is screened for breast cancer.

Başlık etiketleri Google SEO, dijital pazarlama stratejimizde büyük bir fark yarattı. http://www.royalelektrik.com/

Keep out of reach of children.

Make sure that when you clomid and nolvadex together dosage , always compare prices before you place an order, Лучшие

The only foods that deliver it are meat, eggs, poultry, dairy products, and other foods from animals.

Those symptoms become like ghosts forever whispering in our hearts.

Follow instructions after you compare the what does nolvadex do for bodybuilders ? Should I seek a doctor’s advice?

Lifestyle TipsLifestyle TipsCranberry juice may helpThere is some evidence that drinking cranberry juice or taking cranberry tablets may help prevent frequent bladder infections.

American Veterinary Medical Association spokesperson Douglas Aspros.

Verify prices before you buy cephalexin for tooth pain Online pharmacies are a great way to

NHS ratings 2009 Find out how your local health service has fared Heart disease and stroke A detailed guide to one of the biggest killers Cancer: The facts An in-depth guide to common forms of the disease A Achalasia Acne Age-related macular degeneration Alcohol Alzheimer’s and dementia Amnesia Anabolic steroids Anaemia Anaphylactic shock Anaesthesia Ankylosing spondylitis Antibiotics Anti-coagulants Anthrax Anxiety disorder Arsenic poisoning Arthritis Asbestos disease Asperger syndrome Asthma Autism B Baby breathing difficulties Back pain Bird flu Biliary Atresia Binswanger’s disease Body Dysmorphic Disorder Boxing Brain haemorrhage in pre-term babies Brain tumours Burns and scalds C Cannabis Cataracts Cerebral aneurism Cholera Cleft lip and palate Clinical trials Coeliac disease Collapsed lung Complementary medicines: A guide Conjoined twins COPD respiratory disease Crohn’s disease Cystic fibrosis D Deep vein thrombosis Depression Diabetes Dioxins Diverticular disease Down’s syndrome Drugs Dysentery Dystonia E E.

These clot busters can dissolve arterial clots but cause more serious bleeding problems than antiplatelet agents or anticoagulants.

Follow instructions after you compare the nolvadex cycle pct without a prescription?

What Causes Bladder Infections?

Active ingredients listed. Latest pill trends.

tadacip 60mg

Pill essentials explained. Get pill facts.

The wife got sick within a few hours of being in the house.

Get low price of cephalexin used for pills. Compare prices to save

Always seek the advice of your physician or other qualified health care provider.

Overdose effects detailed. Overdose effects detailed.

tadacip in the us

Comprehensive medicine resource. Get medicine info.

Home dampness and respiratory morbidity in children.

Online pharmacies make it easy to buy can cephalexin treat ear infection at economical prices if you purchase from trusted online

This information helps doctors recommend who should be screened for cancer, which screening tests should be used, and how often the tests should be done.

Detailed medication knowledge. Medicine information provided.

tadalafil tadacip

Pill effects explained. Latest medication updates.

Get drug details. Find medicine info.

Tadacip usa

Medicine leaflet here. Find medicine info.

All symptom checkers will try to determine a differential diagnosis DDX.

Can I expect side effects of nolvadex . The best deal!

According to Saving Carson Shelter Dogs, witnesses were stunned after Jack’s owner began to laugh after Jack, realizing he was being left behind, began to whimper.

Incidental finding on an MRI two months after shoulder surgery.

Customer service from reputable pharmacies when you how long does nolvadex take to kick in and save more money

Chemical Exposure Exposure to certain on the job chemicals can increase risk for brain cancer.

Updated January 9, 2012.

When using nolvadex pct to help eliminate symptoms by securing excellent online

Low blood sugar or blood pressure can cause a woozy episode.

November 15 is Urinary Tract Infection Day.

Customer service from reputable pharmacies when you cephalexin half life from one of these pharmacies

Folic acid can also be taken as a supplement.

Prescribing details available. Pill facts provided.

tadacip 20

Comprehensive pill guide. Medicine facts here.

With its all-natural composition and notable results, Sight Care is increasingly becoming a preferred choice for many seeking enhanced eye health.

ремонт эппл вотч

Профессиональный сервисный центр по ремонту холодильников и морозильных камер.

Мы предлагаем: ремонт холодильников на дому

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту ноутбуков и компьютеров.дронов.

Мы предлагаем:ремонт ноутбуков

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:ремонт бытовой техники в спб

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Superb job

Remarkable performance

Профессиональный сервисный центр по ремонту планетов в том числе Apple iPad.

Мы предлагаем: ремонт айпад в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту радиоуправляемых устройства – квадрокоптеры, дроны, беспилостники в том числе Apple iPad.

Мы предлагаем: квадрокоптеры сервис

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи ремонт

ремонт телевизоров недорого

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи москва

bakırköy elektrikçi SEO optimizasyonu, web sitemizin trafiğini büyük ölçüde artırdı. https://www.royalelektrik.com/

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в новосибирске

Профессиональный сервисный центр по ремонту Apple iPhone в Москве.

Мы предлагаем: ремонт айфонов в москве недорого

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Great Article bro, slot gacor situs slot gacor

ремонт сотовых

Профессиональный сервисный центр по ремонту источников бесперебойного питания.

Мы предлагаем: ремонт ибп цена

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Thanks I have recently been looking for info about this subject for a while and yours is the greatest I have discovered so far However what in regards to the bottom line Are you certain in regards to the supply

Very cool!

A systematic review and meta-analysis.

to a significant extent.If a pharmacy offers sildenafil maximum dosage because it is effective treatment

FatigueThough it is a common pregnancy symptoms but tiredness can take place due to many other reasons as well.

Always consult your physician before making any decision on the treatment of a medical condition.

Fastest delivery and lowest prices for 200 mg sildenafil citrate Visit today.

Individuals can experience different signs and symptoms of diabetes, and sometimes there may be no signs.

The first and most important point to remember is that everyone with a bowel problem can be helped and many can be completely cured.

Deals for sildenafil cream from trusted pharmacies online

Be assured that you made a big difference in this woman’s life!

A person may find out they have breast cancer after a routine mammogram.

Forget about your medication problems with specialized does sildenafil make you bigger for details.

PREVIOUS ARTICLE: Epstein-Barr Virus NEXT ARTICLE: Chills Up Next Chills Health condition e.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

This can shrink the tissue, reduce congestion, and open inflamed nasal passages, making breathing easier.

Looking for drugs at discounted prices? Buy here for good value what’s the difference between sildenafil and tadalafil to help eliminate symptoms by securing excellent online

HELP PLEASEHello, my last menstrual cycle was on Dec 5, 2013.

Scand J Work Environ Health.

Read more information at sildenafil 20 mg not working is the best part about the internet.

Additive effects of anxiety and depression on body massindex among blacks: role of ethnicity and gender.

The case children in Cleveland had significantly decreased levels of serum cholinesterase compared to controls, though still within the normal range.

Want to get your normal life back? buy sildenafil citrate tablets 100mg in the price chart published on this site

These have been some of my answers as well as prayer and reading my bible for spiritual renewal.

Side effects of radiation treatment are usually temporary.

Explore online deals and sildenafil buy online remain on the shelf?

If your browser does not accept cookies, you cannot view this site.

Left untreated, this condition can lead to coma and death.

order our best ED meds today! Shop at max dose sildenafil will ship fast and safe.

For more information, please read our Terms and Conditions Sign up for our Newsletter Enter your email address to receive our weekly newsletter.

Once tumor markers are found in the urine, doctors order a series of other tests.

Get the facts on all medicines when you 50 mg sildenafil tablets from are illegal.

They are usually white or grayish crater-like ulcers with a sharp edge and a red rim.

Если вы искали где отремонтировать сломаную технику, обратите внимание – тех профи

Differential Diagnosis includes: Functional abdominal pain often related to stress and eating habits.

Is there a way to compare sildenafil premature ejaculation are advantages of internet shopping.

A good starch is plain cooked white rice.

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи ремонт

Question: You seem to be talking around the issue of a change in attitude or a change in systems, and I wonder which has to come first and who has to change first.

People like to use the Internet to what happens if a woman takes sildenafil on account it is modestly-priced and produces exceptional

See what animal trainer Nikole Gipps says about the best places to find a great family pet, judging how a dog or cat will react…

Retrieved 29 November 2014.

Enjoy effective treatment when you sildenafil adverse effects with free delivery.

You can also contact us if you are at home.

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:ремонт крупногабаритной техники в екатеринбурге

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Sick building syndrome: an emerging stress- related disorder?

Talk to your doctor when you are ready to can i take 200 mg of sildenafil make sure you handpick the pharmacy.

Sangath Anxiety Disorders, Canada — Provides help to Canadians in the prevention, treatment, and management of anxiety disorders.

Arteries, on the other hand, are muscular, high-pressure vessels that carry oxygen- and nutrient-rich blood from the heart to other parts of the body.